- 1. China-Asia Trade Dynamics

- 2. Shipping Methods Across Asia

- 3. Import Duties & Tax Structures

- 4. Top Import Products in Asia

- 5. Cost Calculation Framework

- 6. Customs Clearance Procedures

- 7. Sourcing Reliable Asian Partners

- 8. Asian Free Zones Advantages

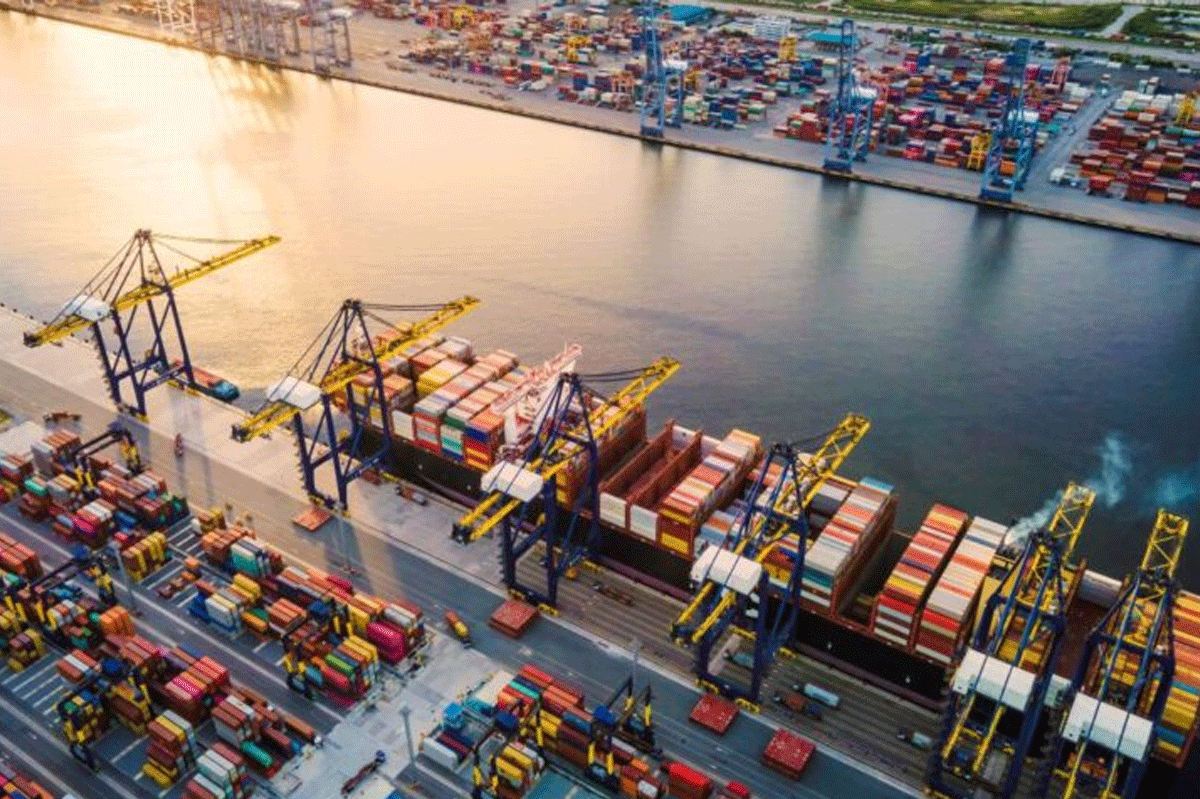

- 9. Major Asian Port Facilities

- 10. Cross-Cultural Business Practices

- 11. Regulatory Compliance Framework

- 12. Risk Mitigation & Insurance

SHIPPING FROM CHINA TO Asia

As a comprehensive one-stop China logistics services forwarder, we offer a full range of freight services to companies with unique shipping needs. Our top priority is safety and on-time delivery, and we strive to provide reliable and cost-effective logistics services to our clients.

If you require freight services for shipping from China to Asia, our website allows you to browse by region and select the countries of interest to obtain more information about our services. We aim to make shipping easy, allowing you to focus on your business while we take care of the rest. As your Asia shipping specialist in China, please feel free to contact us via email overseas.01@winsaillogistics.com or call us (+86) 155 2138 6355

Why Choose Our Asia Logistics Solutions?

Asia-Optimized Shipping Economics

Strategic carrier partnerships deliver market-leading rates for Asia-bound freight, with specialized routing through Shanghai, Singapore, and Port Klang gateways.

Peak Season Capacity Assurance

Exclusive allocations for electronics and textiles during July-September peak periods, with guaranteed LCL/FCL availability.

Cross-Border Visibility

IoT-enabled tracking from Chinese factories to Bangkok/Jakarta warehouses, with real-time updates on Malacca Strait operations.

Multilingual Asia Solutions

Full-service execution including ASEAN certification, Chinese/English/Indonesian documentation, and delivery to 28 Asian countries through regional hubs.

Regional Customs Expertise

In-country teams handle RCEP member country regulations, including duty remission schemes and temporary import permits.

Pan-Asian Support Network

Multilingual (Chinese/English/Indonesian) teams covering Beijing, Singapore, and Dubai time zones, with 24/7 emergency response for port congestion.

Winsail Commitment

Our Mission

To become a leading logistics services provider from China helping small and medium-sized enterprises succeed.

Our Vision

To grow our business together with growth of our staff, suppliers, and clients.

Our Slogan

Bear your cargo, March with safe and efficient.

2024 Complete Guide - Shipping from China to Asia: Regional Insights

Shipping goods from China to Asia requires specialized knowledge of continental logistics networks and diverse regional trade dynamics. This comprehensive guide provides Asia-specific insights to optimize your supply chain and navigate the unique aspects of intra-Asian trade routes effectively.

1. China-Asia Trade Dynamics

| Key Indicator | 2024 Data | Regional Trend |

|---|---|---|

| Bilateral Trade Volume | $892 billion (Jan-Jun 2024) | ↑ 8.3% YoY |

| Top Export Categories |

• Electronics & components (38%) • Machinery & equipment (22%) • Textiles & apparel (16%) |

↑ Green tech +34% ↑ Automotive parts +19% |

| Strategic Advantages |

• Regional supply chain integration • Digital economy expansion • Infrastructure development initiatives |

Accelerating post-pandemic recovery |

Pro Tip: Asia's Regional Comprehensive Economic Partnership (RCEP) has reduced tariffs on 90% of traded goods among member states, creating unprecedented cross-border trade opportunities through 2024-2025.

2. Shipping Methods Across Asia

| Method | Transit Time | Cost Range | Best For | Key Providers |

|---|---|---|---|---|

| Express Courier (Intra-Asia) |

2-5 days | $3-$12/kg |

• Samples & documents • High-value small items • Urgent shipments <30kg |

SF Express, Ninja Van, DHL Asia |

| Regional Air Freight | 3-7 days | $2-$8/kg |

• Fashion goods • Electronics • Time-sensitive cargo |

Cathay Pacific Cargo, China Southern Cargo |

| Sea LCL (Intra-Asia) |

5-21 days | $50-$180/CBM |

• 1-12 CBM shipments • General merchandise • Cost-efficient transport |

OOCL, Evergreen, Cosco Shipping |

| Sea FCL (Intra-Asia) |

4-18 days |

20': $400-$1,800 40': $700-$3,200 40HQ: +$300 |

• Full container loads • Bulk commodities • Regular shipments |

Maersk Line, MSC, HMM |

Pro Tip: For Southeast Asian destinations, consider multi-modal solutions combining sea freight to regional hubs with trucking connections, reducing total costs by 15-25% compared to direct shipping.

3. Import Duties & Tax Structures

| Fee Type | Regional Range | Calculation Basis | Common Exemptions |

|---|---|---|---|

| Customs Duty |

• Average: 0-20% • Luxury goods: up to 50% • Industrial equipment: 0-5% |

CIF Value (Cost+Insurance+Freight) |

• Raw materials (selected) • Medical supplies • RCEP-origin products |

| VAT/GST | 5-18% (varies by country) |

CIF Value + Customs Duty |

• Essential food items • Medical equipment • Export-bound goods |

| Additional Levies |

• Import processing: 0.1-2% • Safety inspection: 0.5-3% • Environmental fees: 0-5% |

CIF Value or Duty Paid Value | Free trade zone shipments |

| Documentation Fees |

• Customs clearance: $30-$200 • Terminal handling: $50-$300 • Certificate fees: $20-$150 |

Per shipment | Diplomatic and humanitarian shipments |

Pro Tip: Utilize RCEP rules of origin to qualify for preferential tariff rates, which can reduce duty costs by 30-100% for products with sufficient regional content.

4. Top Import Products in Asia

| Product Category | Top Selling Items | Market Share | Profit Margin | Key Suppliers |

|---|---|---|---|---|

| Electronics & Tech |

• Semiconductor components • Consumer electronics • 5G infrastructure • Renewable energy tech |

32% | 25-55% |

Shenzhen, Shanghai |

| Machinery & Parts |

• Manufacturing equipment • Automotive components • Agricultural machinery • Construction equipment |

24% | 18-45% |

Qingdao, Guangzhou |

| Textiles & Apparel |

• Fabric materials • Ready-to-wear garments • Technical textiles • Footwear |

18% | 15-40% |

Yiwu, Hangzhou |

| Chemicals & Materials |

• Plastics & polymers • Specialty chemicals • Construction materials • Packaging materials |

16% | 12-35% |

Ningbo, Tianjin |

Pro Tip: Renewable energy components (solar panels, wind turbine parts) have shown exceptional demand growth (28% YoY) across Asia, driven by regional net-zero commitments and energy security initiatives.

5. Cost Calculation Framework

| Cost Component | 20' Container | 40' Container | LCL (per CBM) | Notes |

|---|---|---|---|---|

| Intra-Asia Freight | $400-$1,800 | $700-$3,200 | $50-$180 | From Shanghai/Shenzhen |

| Customs Duties (avg 8%) | 0-20% of goods value | 0-20% of goods value | 0-20% of CIF | RCEP rates apply for qualified goods |

| VAT/GST | 5-18% of (Goods+Freight+Duty) | 5-18% of (Goods+Freight+Duty) | 5-18% of (Goods+Freight+Duty) | Country-specific rates |

| Terminal & Port Fees | $150-$500 | $250-$800 | $30-$120 | Includes THC, documentation, security |

| Inland Transportation | $50-$500 | $100-$800 | $15-$100/CBM | Depends on distance from port |

Pro Tip: Consolidating shipments to regional hubs (Singapore, Hong Kong, Shanghai) before final distribution can reduce total logistics costs by 15-25% compared to direct shipping to multiple Asian destinations.

6. Customs Clearance Procedures

| Step | Timeframe | Required Documents | Fee Range | Digital Systems |

|---|---|---|---|---|

| 1. Pre-Arrival Submission | 1-3 days before arrival |

• Commercial invoice (local language) • Packing list • Bill of Lading/AWB • RCEP Certificate of Origin (if applicable) |

$20-$100 (electronic submission) | National single window systems |

| 2. Customs Assessment | 1-5 working days |

• Product certifications • Import licenses (if required) • Additional declarations |

$50-$300 (processing fee) | Risk-based inspection systems |

| 3. Duty Payment | Same day processing |

• Payment confirmation • Tax assessment notice |

Duty + VAT/GST + transaction fee | Electronic payment gateways |

| 4. Cargo Release | 4-24 hours after payment |

• Delivery order • Release authorization • Proof of payment |

$30-$150 (release fee) | Port community systems |

Pro Tip: Utilizing Authorized Economic Operator (AEO) status can reduce customs inspection rates by 60-80% in most Asian countries, significantly accelerating clearance times.

7. Sourcing Reliable Asian Partners

| Partner Type | Advantages | Considerations | Verification Methods | Recommended Channels |

|---|---|---|---|---|

| Manufacturers |

• Competitive pricing • Product customization • Quality control oversight |

• Higher minimum order quantities • Limited regional distribution |

• Factory audits • Export license verification • Regional client references |

• Canton Fair • Global Sources • Industry-specific trade shows |

| Trading Companies |

• Lower MOQ flexibility • Regional market expertise • Consolidated shipping options |

• Higher price margins • Variable quality control |

• Trade references • Sample verification • Financial stability check |

• Alibaba.com • Made-in-China.com • Local chambers of commerce |

| Logistics Partners |

• Regional network coverage • Customs clearance expertise • Multi-modal solutions |

• Service fee structure • Coverage limitations |

• Operational facility visits • Client testimonials • Compliance certifications |

• FIATA members • WCA network • Industry awards recognition |

Pro Tip: Establishing relationships with local agents in target Asian markets reduces compliance risks by 40-60% and provides valuable insights into regional business practices and regulatory changes.

8. Asian Free Zones Advantages

| Free Zone | Location | Key Benefits | Setup Investment | Ideal Business Activities |

|---|---|---|---|---|

| Hong Kong Free Port | Hong Kong SAR |

• Zero tariffs on imports/exports • No VAT/GST • Simple customs procedures |

$30,000-$100,000+ | Trading, logistics, financial services |

| Singapore Free Trade Zone | Singapore |

• Duty exemption on re-exports • GST suspension • Efficient customs processing |

$50,000-$200,000+ | Regional distribution, high-tech manufacturing |

| Jebel Ali Free Zone | Dubai, UAE |

• 100% foreign ownership • 50-year tax holiday • Strategic East-West location |

$15,000-$50,000+ | Re-export hub, logistics, light manufacturing |

| Batam Free Trade Zone | Batam, Indonesia |

• Proximity to Singapore • Lower operational costs • Export-oriented incentives |

$10,000-$30,000+ | Electronics assembly, textiles, tourism goods |

Pro Tip: Asian free zones offer strategic advantages for regional distribution, with average cost savings of 20-35% on duties and taxes for goods transiting through these zones before final delivery.

9. Major Asian Port Facilities

| Port | Specifications | Operational Capabilities | Storage Terms | Strategic Advantages |

|---|---|---|---|---|

| Shanghai Port |

• 125 berths • 16m draft • 47M+ TEU capacity |

• Fully automated terminals • 24/7 operations • Comprehensive cargo handling |

• 7 days free • $15-$30/day after |

Gateway to Yangtze River Delta, global connectivity |

| Singapore Port |

• 57 berths • 16m draft • 37M+ TEU capacity |

• Transshipment hub • Digital clearance systems • Integrated logistics services |

• 14 days free (transshipment) • $20-$40/day after |

Strategic location on major East-West trade routes |

| Busan Port (South Korea) |

• 65 berths • 16m draft • 23M+ TEU capacity |

• Northeast Asia hub • Advanced container terminals • Rail connectivity to China/Europe |

• 5 days free • $18-$35/day after |

Gateway to Korean peninsula and northeast China |

| Jebel Ali Port (UAE) |

• 67 berths • 18m draft • 22M+ TEU capacity |

• Free zone integration • Multi-purpose terminals • Regional distribution hub |

• 30 days free (in free zone) • $12-$25/day after |

Gateway to Middle East, Africa, and South Asia |

Pro Tip: Utilizing transshipment through Singapore or Hong Kong can reduce overall shipping costs by 10-20% for multi-destination Asian shipments compared to direct port calls.

10. Cross-Cultural Business Practices

| Aspect | Asian Norms | Western Comparison | Business Implications | Recommended Approach |

|---|---|---|---|---|

| Relationship Building |

• Trust precedes business • Face-to-face meetings essential • Personal connections matter greatly |

Often transaction-focused Emphasis on contracts |

Rushing negotiations can damage opportunities | Invest time in relationship building, respect hierarchy |

| Communication Styles |

• High-context communication • Indirect feedback common • Non-verbal cues important |

Direct, low-context communication Explicit feedback valued |

Misinterpretation risks without cultural awareness | Listen actively, ask clarifying questions, observe non-verbal cues |

| Negotiation Dynamics |

• Gradual consensus building • Flexibility valued over fixed positions • Group decision-making common |

Direct bargaining Individual decision authority Focus on outcomes |

Timeframes often longer than Western expectations | Allow sufficient time, avoid pressure tactics, respect protocols |

Pro Tip: Understanding cultural dimensions like "face" (mianzi) in East Asia and "harmony" in Southeast Asia can significantly improve business relationships and negotiation outcomes across Asian markets.

11. Regulatory Compliance Framework

| Requirement | Affected Products | Key Standards | Non-Compliance Risks | Compliance Strategies |

|---|---|---|---|---|

| Product Certification |

• Electrical equipment • Electronics • Medical devices • Toys and children's products |

• CCC (China) • PSE (Japan) • SIRIM (Malaysia) • TISI (Thailand) |

• Product seizure • Fines up to 200% of value • Market bans |

Pre-export certification, third-party testing |

| Labeling Requirements |

• Consumer products • Food and beverages • Pharmaceuticals • Cosmetics |

• Local language mandates • Ingredient listings • Safety warnings • Origin labeling |

• Mandatory relabeling • Delays and fines • Product rejection |

Country-specific labeling, local language compliance |

| Import Restrictions |

• Agricultural products • Chemicals • Media and publications • Strategic goods |

• Quota systems • Licensing requirements • Sanitary regulations • Security clearances |

• Shipment delays • Forfeiture of goods • Legal penalties |

Advance permits, local partner guidance, regulatory updates |

Pro Tip: Regulatory requirements vary significantly across Asian countries. Implementing a country-specific compliance checklist reduces non-compliance risks by 70-80% and avoids costly delays.

12. Risk Mitigation & Insurance

| Coverage Type | Premium Rate | Key Protections | Exclusions | Claims Process |

|---|---|---|---|---|

| Marine Cargo Insurance |

0.3-0.8% of cargo value |

• Loss or damage at sea • Port handling issues • Fresh water damage • Theft during transit |

• War and strikes • Inherent vice • Improper packaging |

• Immediate notification • Survey report within 5 days • 20-40 day processing |

| Political Risk Coverage |

0.2-0.6% of cargo value |

• Trade restrictions • Currency inconvertibility • Political violence • Expropriation |

• Commercial disputes • Sanctions violations • Pre-existing conflicts |

• Official documentation • Government declarations • 45-60 day processing |

| Multimodal Transport |

0.5-1.2% of cargo value |

• Combined sea/air/land risks • Warehouse storage • Last-mile delivery • Customs holding |

• Extended storage beyond terms • Unauthorized handling • Nuclear incidents |

• Carrier documentation • Proof of damage/loss • 30-50 day processing |

Pro Tip: A comprehensive insurance package covering marine, political, and multimodal risks (total 1.0-2.5% of cargo value) is recommended for pan-Asian shipments given the diverse risk profiles across the region.

Conclusion: Your China-Asia Shipping Strategy

This comprehensive guide has equipped you with Asia-specific knowledge to:

✓ Navigate the diverse Asian market landscape effectively

✓ Select optimal shipping routes and methods for different Asian regions

✓ Calculate accurate landed costs across various Asian countries

✓ Understand and comply with diverse regulatory environments

✓ Identify high-potential product categories for Asian markets

✓ Manage risks unique to Asian trade routes

Next Steps:

1. Conduct detailed market research for your target Asian countries

2. Establish relationships with local partners in key Asian markets

3. Develop a regional distribution strategy leveraging Asian free zones

4. Implement a comprehensive compliance and risk management system

For personalized consultation on your China-Asia shipping strategy, contact our experts today for a free market assessment and tailored logistics solution designed for Asian markets.