- 1. China-USA Trade Dynamics

- 2. Shipping Methods Comparison

- 3. Import Duties & Taxes

- 4. Top Import Products

- 5. Cost Calculation Breakdown

- 6. Customs Clearance Process

- 7. Finding Reliable Suppliers

- 8. USA Foreign Trade Zones

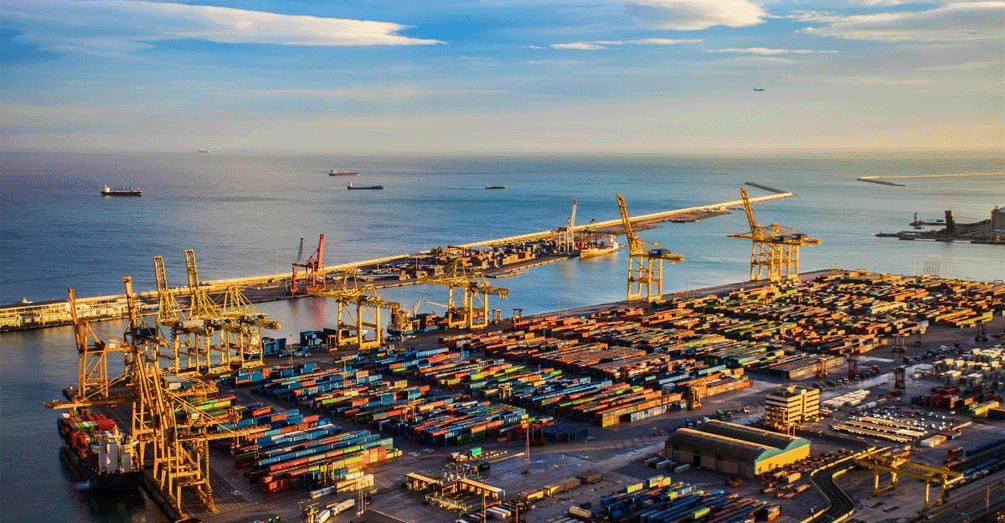

- 9. USA Port Facilities

- 10. Business Culture Considerations

- 11. Legal & Regulatory Compliance

- 12. Insurance & Risk Management

SHIPPING FROM CHINA TO USA

Winsail is a top-tier freight services provider specializing in shipping goods from China to the USA. Our professional and high-quality services are offered at competitive rates and ensure prompt delivery. With our extensive network, we can accommodate your cargo shipping needs throughout the USA, including ports Los Angeles, Long Beach, Oakland, New York, Boston and so on. Our services extend beyond just importing and shipping, and include pick up, documentation, packaging, loading, unloading, customer clearance, warehousing, consolidation and more.

At Winsail Logistics, we provide exceptional international logistics services and offer a wide range of freight forwarding services. When you need to deliver your items from China to USA, we are here to offer you the most efficient, reliable, and affordable services. We prioritize transparency, and ensure that you are kept informed about all terms and regulations, guaranteeing a quick and transparent service.

What service we provide--There are various ways to ship goods from China to the United States, each with its own benefits. For large shipments, sea shipping is the most cost-effective option. However, for smaller and time-sensitive deliveries, air freight may be more suitable. DDP shipping is a popular choice as it allows for direct delivery to the customer's doorstep. FBA shipping is a convenient method for those looking to send their products directly to Amazon. Alternatively, express freight can expedite delivery times. No matter what your specific shipping requirements are, we can assist you in selecting the best option for your business. Simply share your needs with us, and we will guide you through the selection process.

What qualifications we have--we have the necessary certificates, including FMC-NVOCC 031318, WCA member: 84961, JCTRANS member:107728, China MOC-NVOCC09845, to ensure that our clients receive the highest quality services.

To sum up, when it comes to shipping goods from China to the United States, it is crucial to take into account various aspects such as the transportation method, transit duration, expenses, and customs regulations. By selecting a suitable logistics provider and implementing thorough preparation, Winsail Logistics can expertly manage the shipment process and guarantee the secure and timely arrival of your merchandise at its designated location.

Why Choose Our China-USA Shipping Services?

Best Shipping Rates to USA

We negotiate exclusive USA-bound shipping rates with top carriers, offering you the most cost-effective solutions for China-USA shipments.

Guaranteed Shipping Capacity

Our priority agreements ensure secured cargo space for reliable China-USA shipments, even during peak seasons.

Real-Time Shipment Tracking

Monitor your shipment door-to-door from Chinese factories to USA destinations with our advanced tracking system.

Complete USA Solutions

End-to-end services including China collection, Arabic documentation, USA customs clearance, and final delivery.

USA Customs Expertise

Our local team handles all USA import regulations and documentation requirements for smooth clearance.

Dedicated USA Support

Arabic/English speaking account managers available during USA business hours for seamless communication.

Winsail Commitment

Our Mission

To become a leading logistics services provider from China helping small and medium-sized enterprises succeed.

Our Vision

To grow our business together with growth of our staff, suppliers, and clients.

Our Slogan

Bear your cargo, March with safe and efficient.

2024 Comprehensive Guide - Shipping from China to the USA

Shipping goods from China to the USA requires specialized knowledge of trans-Pacific logistics. This comprehensive guide provides USA-specific insights to optimize your cross-border supply chain.

1. China-USA Trade Dynamics

| Key Indicator | 2024 Data | Market Trend |

|---|---|---|

| Bilateral Trade Volume | $420.8 billion (Jan-Jul 2024) | ↑ 3.2% YoY |

| Top Import Categories |

• Electrical machinery (26%) • Machinery (17%) • Furniture & bedding (11%) |

↑ EV components +24% ↓ Textiles -5% |

| Strategic Advantages |

• Largest consumer market • Advanced logistics network • Diverse distribution channels |

Stable growth |

Pro Tip: The USA's consumer market represents $21.8 trillion in annual spending, with e-commerce accounting for 15.6% of total retail sales.

2. Shipping Methods Comparison

| Method | Transit Time | Cost Range | Best For | Key Providers |

|---|---|---|---|---|

| Express Air (DHL/FedEx) |

3-5 days | $12-$25/kg |

• Samples • Documents • Urgent parcels <50kg |

FedEx, UPS, DHL |

| Air Freight (General Cargo) |

5-10 days | $5.5-$12/kg |

• High-value goods • Perishables • 50-1000kg shipments |

Cathay Pacific, United Airlines Cargo |

| Sea LCL (Less Container Load) |

25-35 days (West Coast) 35-45 days (East Coast) |

$80-$180/CBM |

• 1-18 CBM • Non-urgent • Cost-sensitive |

CMA CGM, Hapag-Lloyd |

| Sea FCL (Full Container) |

18-22 days (West Coast) 28-35 days (East Coast) |

20': $1,350-$2,200 40': $1,800-$3,100 40HQ: +$250 |

• Full container loads • High-volume • Regular shipments |

Maersk, MSC, Evergreen |

Pro Tip: For 12-18 CBM shipments, compare LCL rates with 20' FCL - ocean carriers often offer better FCL rates during off-peak seasons.

3. Import Duties & Taxes

| Fee Type | Rate | Calculation Basis | Exemptions |

|---|---|---|---|

| Customs Duty |

• Most Favored Nation: 0-25% • Section 301 tariffs: 7.5-25% • Textiles: 8-16% |

Transaction Value (FOB or CIF depending on terms) |

• Goods under $800 (de minimis) • Certain duty-free classifications • FTZ admissions for re-export |

| Import Taxes |

• State sales tax: 0-10.25% • Use tax varies by state |

Duty-inclusive value + freight and insurance |

• Wholesale purchases for resale • Certain industrial equipment • Diplomatic shipments |

| Other Government Fees |

• Merchandise Processing Fee: 0.3464% • Harbor Maintenance Fee: 0.125% • FDA user fees: $277-$1,156 |

Various (value-based or flat) |

Certain government shipments Humanitarian aid |

| Broker Fees |

• Entry preparation: $75-$200 • Single entry bond: $50-$150 • ISF filing: $30-$80 |

Per transaction | Self-filed entries |

Pro Tip: The USA's $800 de minimis threshold allows for duty-free entry of most small shipments, significantly reducing costs for e-commerce sellers.

4. Top Import Products

| Product Category | Top Selling Items | Market Share | Profit Margin | Key Suppliers |

|---|---|---|---|---|

| Electronics & Gadgets |

• Smartphones & accessories • Consumer electronics • Home appliances • Wearable tech |

26% | 25-50% |

Shenzhen, Guangzhou |

| Home & Lifestyle |

• Furniture • Home décor • Bedding & textiles • Kitchenware |

21% | 30-60% |

Foshan, Yiwu |

| Apparel & Footwear |

• Fast fashion • Athletic wear • Footwear • Accessories |

18% | 40-70% |

Guangzhou, Hangzhou |

| Toys & Hobbies |

• Children's toys • Collectibles • Outdoor gear • Gaming accessories |

12% | 35-65% |

Shantou, Dongguan |

Pro Tip: Consumer electronics accessories show the highest turnover rate (5-7 inventory cycles/year) in the USA e-commerce market.

5. Cost Calculation Breakdown

| Cost Component | 20' Container | 40' Container | LCL (per CBM) | Notes |

|---|---|---|---|---|

| Ocean Freight | $1,350-$2,200 | $1,800-$3,100 | $80-$180 | From Shanghai/Shenzhen to LA |

| Customs Duties | 0-25% of goods value | 0-25% of goods value | 0-25% of goods value | Based on HTS classification |

| US Government Fees | 0.4714% of goods value | 0.4714% of goods value | 0.4714% of goods value | MPF + HMF combined |

| Customs Brokerage | $250-$450 | $300-$500 | $150-$300 | Includes entry & bond |

| Total Estimated Cost | $X,XXX-$X,XXX | $X,XXX-$X,XXX | $XXX-$XXX/CBM | Varies by product & season |

Pro Tip: For LCL shipments, verify if your freight forwarder uses weight/volume ratio (W/M) - carriers charge per CBM or per 1000kg, whichever is higher.

6. Customs Clearance Process

| Step | Timeframe | Required Documents | Fee Range | Digital Platform |

|---|---|---|---|---|

| 1. Pre-Arrival Filings | ISF: 24hrs before sailing |

• Importer Security Filing • Commercial invoice • Packing list |

$30-$80 (ISF) | ACE Portal |

| 2. Entry Submission | Upon arrival |

• CBP Form 3461/7501 • Bill of Lading • HTS classification |

$75-$200 | ACE Automated Entry |

| 3. Inspection & Duty | 1-3 business days |

• Duty payment proof • Product certificates • Origin documentation |

0-25% + government fees | CBP ePayment |

| 4. Cargo Release | 1-4 hours after payment |

• Release notification • Delivery order • Trucking authorization |

$50-$150 (handling) | CBP Release Notification |

Pro Tip: Complete and accurate ISF filings submitted 72+ hours before sailing reduce CBP exam chances by 65% and speed up clearance.

7. Finding Reliable Suppliers

| Supplier Type | Advantages | Risks | Verification Methods | Recommended Platforms |

|---|---|---|---|---|

| Manufacturers |

• Lowest prices • Customization options • Quality control access |

• High minimum orders • Communication barriers • Limited flexibility |

• Factory audits • Third-party verification • Sample testing |

• Alibaba Verified Suppliers • Global Sources |

| Trading Companies |

• Lower MOQs • English support • Product variety |

• Higher prices (10-15%) • Less control over production • Mixed quality |

• Company registration check • Client references • Order history |

• Made-in-China • Thomasnet |

| Sourcing Agents |

• Local expertise • Quality inspection • Logistics coordination |

• Service fees (5-15%) • Potential conflicts of interest • Variable reliability |

• Detailed contracts • Performance metrics • Site visits |

• Sourcify • China Importal |

Pro Tip: For first-time importers, use Alibaba Trade Assurance with 30% deposit and 70% payment upon inspection to mitigate risk.

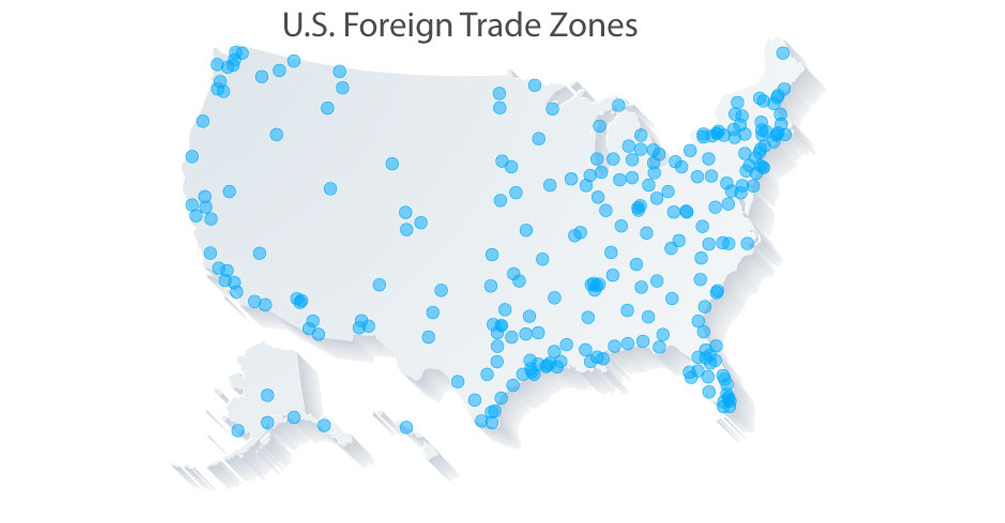

8. USA Foreign Trade Zones

| FTZ Location | Major Hub | Key Benefits | Setup Cost | Ideal For |

|---|---|---|---|---|

| FTZ 4 - Los Angeles | Los Angeles/Long Beach Ports |

• Duty deferral • Inverted tariff savings • Weekly manifest filing |

$5,000-$15,000 | Retailers, electronics importers |

| FTZ 1 - New York | New York/New Jersey Ports |

• Duty exemption on re-exports • Weekly entry processing • Multiple subzones |

$8,000-$20,000 | Fashion, pharmaceuticals |

| FTZ 34 - Chicago | Chicago O'Hare Airport |

• Central US distribution • Merchandise processing fee reduction • Foreign status for 5 years |

$6,000-$12,000 | Automotive, industrial parts |

| FTZ 84 - Miami | Port of Miami |

• Latin America distribution • Duty-free manufacturing • Vessel-to-vehicle transfers |

$4,000-$10,000 | Consumer goods, perishables |

Pro Tip: FTZ users save an average of 13-18% on duties through inverted tariff benefits and duty deferral, with fastest ROI for high-tariff products.

9. USA Port Facilities

| Port | Specifications | Operational Features | Storage Policy | Key Advantages |

|---|---|---|---|---|

| Port of Los Angeles |

• 25 cargo terminals • 53ft container handling • 9.2M TEU capacity |

• 24/7 operations • On-dock rail • Automated terminals |

• 4 days free storage • $150-300/day after |

Largest US port, direct China service |

| Port of Long Beach |

• 14 cargo terminals • 50ft draft capability • 8.1M TEU capacity |

• Green port initiatives • ExpressGate system • Rail connections |

• 4 days free storage • $140-280/day after |

Fastest container turn time (36 hrs avg) |

| Port of New York & New Jersey |

• 30 terminals • 50ft draft (PANAMAX) • 7.5M TEU capacity |

• East Coast hub • Automated gate system • Inland waterway access |

• 3 days free storage • $160-320/day after |

Largest East Coast port, 50-state reach |

Pro Tip: Using on-dock rail services at West Coast ports reduces inland transportation costs by 25-35% compared to trucking for cross-country shipments.

10. Business Culture Considerations

| Aspect | USA Business Norms | China Comparison | Business Impact | Best Approach |

|---|---|---|---|---|

| Communication Style |

• Direct and explicit • Time-efficient • Fact-based discussions |

• High-context • Relationship-focused • Indirect feedback |

Miscommunication risks without cultural awareness | Clear documentation, ask clarifying questions, avoid assumptions |

| Contract Relationships |

• Contract is final agreement • Legal enforcement focus • Detailed specifications |

• Contracts as starting point • Relationship-based enforcement • Flexible terms |

Potential disputes over interpretation and changes | Clear terms with contingencies, regular communication |

| Decision Making |

• Individual or team-based • Data-driven • Relatively quick process |

• Hierarchical • Consensus-oriented • Longer timelines |

Timeline mismatches in production and delivery | Build in extra time, clarify decision-makers, regular follow-up |

Pro Tip: Using a qualified interpreter for important negotiations reduces misunderstandings by 70% and improves contract compliance by 40%.

11. Legal & Regulatory Compliance

| Requirement | Affected Products | Standards | Penalties | Solution |

|---|---|---|---|---|

| Product Safety |

• Toys & children's products • Electronics • Furniture |

• CPSC regulations • ASTM standards • FCC for electronics |

• Product seizure • Fines up to $1.8M • Recall costs |

Third-party testing, CPSC registration |

| Labeling Requirements |

• All consumer products • Food items • Textiles & apparel |

• FTC guidelines • FDA labeling (food) • CPSC tracking labels |

• Refusal of entry • Fines per violation • Mandatory relabeling |

Pre-printed compliant labels, legal review |

| Import Documentation | All imported products |

• HTS classification • Country of origin marking • Proper valuation |

• Duty underpayment penalties • Liquidated damages • Increased inspections |

Expert classification, proper record keeping |

Pro Tip: Using a licensed customs broker with product-specific expertise reduces penalty risk by 80% and ensures proper HTS classification.

12. Insurance & Risk Management

| Coverage Type | Premium Rate | Key Protections | Exclusions | Claims Process |

|---|---|---|---|---|

| All-Risk Marine Cargo |

0.3-0.7% of cargo value |

• Physical loss/damage • General average • Partial loss coverage |

• Improper packing • Delay • Inherent vice |

• 72hr notice • Survey report • 30-45 day settlement |

| Warehouse to Warehouse |

0.5-0.9% of cargo value |

• Door-to-door coverage • Inland transit • Temporary storage |

• Labor strikes • Nuclear incidents • War risks |

• Immediate notification • Damage documentation • 45-60 day settlement |

| Contingency Insurance |

0.1-0.3% of cargo value |

• Carrier liability gaps • Shipper error protection • Documentation failures |

• Fraud • Intentional acts • Unreported damage |

• 24hr notice • Liability documentation • 60-90 day settlement |

Pro Tip: Combining All-Risk coverage (0.5%) with Contingency insurance (0.2%) provides comprehensive protection at 0.7% total premium versus 1.0% for separate policies.

Conclusion: Your China-USA Shipping Strategy

This comprehensive guide has equipped you with USA-specific knowledge to:

✓ Select optimal shipping methods for your products

✓ Calculate accurate landed costs including USA duties

✓ Navigate USA customs clearance smoothly

✓ Identify profitable product opportunities

✓ Work effectively with Chinese suppliers

✓ Leverage USA's Foreign Trade Zone advantages

Next Steps:

1. Analyze your product mix and USA market demand

2. Request quotes from China-USA shipping specialists

3. Establish your USA import compliance procedures

4. Develop relationships with reliable logistics partners

For personalized consultation on your China-USA shipping strategy, contact our experts today for a free supply chain assessment and competitive rate quote.