- 1. China-Oceania Trade Dynamics & Market Trends

- 2. Oceania Shipping Methods & Transit Solutions

- 3. Oceania Import Duties & Taxation Structure

- 4. Top Import Products in Oceania Markets

- 5. Oceania Cost Calculation Framework

- 6. Oceania Customs Clearance Procedures

- 7. Sourcing Oceania Logistics Partners

- 8. OceaOceania Free Zones & Logistics Hubs

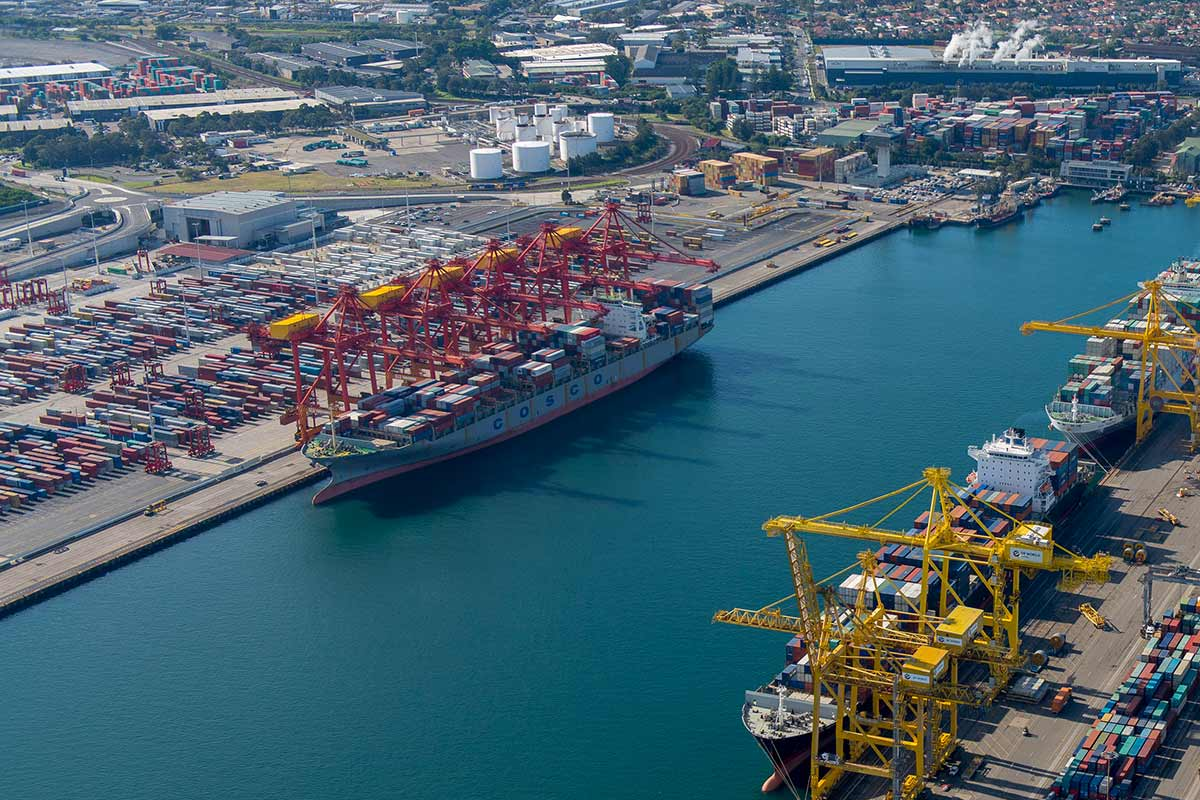

- 9. Major Oceania Port Facilities

- 10. Oceania Business Culture & Practices

- 11.Oceania Regulatory Compliance Framework

- 12. Oceania Cargo Insurance & Risk Mitigation

SHIPPING FROM CHINA TO Oceania

As a leading China-Australia logistics partner, we specialize in tailored freight solutions for businesses shipping to Sydney, Melbourne, and Brisbane. Our integrated services include ocean freight, air cargo, and customs clearance, all backed by real-time tracking systems. We prioritize cargo safety and timely delivery while offering competitive pricing structures.

For companies targeting the Australian market, our platform enables region-specific service selection with detailed port information. Let us handle the complexities of international shipping while you focus on business growth. As your dedicated Australia shipping expert in China, please reach out via email at overseas.01@winsaillogistics.com or call (+86) 155 2138 6355

Why Choose Our Oceania Logistics Solutions?

Oceania-Optimized Freight Networks

Strategic carrier partnerships provide market-leading rates for Sydney/Melbourne-bound cargo, with optimized routing through Shanghai, Ningbo, and Port Klang hubs.

Mining Equipment Peak Capacity

Priority allocations for mining machinery and agricultural equipment during June-August peak periods, with guaranteed FCL availability.

Trans-Pacific Visibility System

IoT-enabled tracking from Chinese factories to Brisbane/Perth warehouses, with real-time updates on Tasman Sea operations.

Multilingual Oceania Solutions

Full-service execution including AQIS certification, Chinese/English/Indonesian documentation, and delivery to 14 Oceanian countries through regional hubs.

Australian Customs Expertise

Licensed brokers handle ABF requirements, including duty remission schemes and temporary import permits for mining exhibitions.

Pan-Oceanian Support Network

Multilingual (Chinese/English/Indonesian) teams covering UTC+8 to UTC+12 time zones, providing 24/7 emergency response for Sydney port congestion.

Winsail Commitment

Our Mission

To become a leading logistics services provider from China helping small and medium-sized enterprises succeed.

Our Vision

To grow our business together with growth of our staff, suppliers, and clients.

Our Slogan

Bear your cargo, March with safe and efficient.

2024 Comprehensive Guide - Shipping from China to Oceania: Market Insights & Logistics

Transporting goods from China to Oceania requires specialized knowledge of Australian and New Zealand customs regulations, regional import procedures, and Pacific logistics networks. This guide delivers Oceania-specific insights to optimize your supply chain and navigate the unique aspects of trans-Pacific trade effectively.

1. China-Oceania Trade Dynamics & Market Trends

| Key Indicator | 2024 Data | Oceania Market Trend |

|---|---|---|

| Bilateral Trade Volume | A$284 billion (2023 total, China-Australia) | ↑ 6.2% YoY |

| Top Import Categories |

• Consumer electronics (29%) • Machinery and equipment (22%) • Textiles and apparel (18%) |

↑ Renewable energy components +72% ↑ Electric vehicle parts +65% |

| Strategic Advantages |

• Stable regulatory environment • Advanced port infrastructure • Growing middle class in major economies |

Booming e-commerce sector driving demand for home goods and technology products |

Pro Tip: Australia's Integrated Cargo System (ICS) and New Zealand's Customs Declaration System (CDS) have reduced processing times by 40% for China-origin shipments with complete electronic documentation in 2024, particularly benefiting containerized cargo through major Pacific ports.

2. Oceania Shipping Methods & Transit Solutions

| Method | Transit Time | Cost Range | Best For | Key Oceania Providers |

|---|---|---|---|---|

| Express Courier (Oceania Domestic) |

1-3 days | A$6.50-A$22.80/kg |

• Samples & documents • High-value small items • Urgent shipments <30kg |

Australia Post, NZ Post, Toll Priority |

| Air Freight | 6-10 days | A$5.80-A$14.20/kg |

• Electronics • Fashion items • Time-sensitive cargo |

Qantas Freight, Air New Zealand Cargo |

| Sea LCL (Oceania-bound) |

21-30 days | A$120-A$280/CBM |

• 1-12 CBM shipments • General merchandise • Cost-efficient transport |

Sydney Ports, Melbourne Container Terminal, Auckland Port Services |

| Sea FCL (Oceania-bound) |

18-25 days |

20': A$1,400-A$3,200 40': A$2,400-A$4,900 40HQ: +A$550 |

• Full container loads • Bulk commodities • Regular shipments |

Maersk Line Australia, 中远海运(大洋洲航线), Pacific International Lines |

| Multimodal (China-Southeast Asia-Oceania) |

25-35 days |

20': A$1,600-A$3,500 40': A$2,700-A$5,300 |

• Small island destinations • Mixed cargo types • Cost-sensitive shipments |

Swire Shipping, Toll Global Forwarding, Mainfreight |

Pro Tip: For shipments to eastern Australia, sea freight to Sydney with domestic forwarding offers 18% faster transit than western ports, while costing 25% less than air freight for comparable volumes.

3. Oceania Import Duties & Taxation Structure

| Fee Type | Oceania Range | Calculation Basis | Oceania Exemptions |

|---|---|---|---|

| Customs Duty |

• Australia average: 0-5% • New Zealand average: 0-3% • Textiles: 5-10% |

FOB or CIF Value (varies by country) |

• Most electronic goods • Medical devices • Certain environmental technologies |

| Goods & Services Tax |

• Australia: 10% • New Zealand: 15% |

CIF Value + Customs Duty |

• Low-value imports (under A$1,000 in Australia) • Certain medical supplies • Goods for re-export |

| Additional Charges |

• Anti-dumping duties: 5-45% • Biosecurity fees: A$40-300 • Quarantine inspection: A$80-450 |

CIF Value or flat rate | Certified organic products, certain humanitarian goods |

| Documentation Fees |

• Customs clearance: A$70-A$350 • Terminal handling: A$100-A$500 • Certificate fees: A$50-A$280 |

Per shipment | Diplomatic shipments, certain government imports |

Pro Tip: Utilize Australia's Digital Trade Gateway or New Zealand's Customs Declaration System for pre-arrival declarations, which can reduce clearance times by 40% compared to traditional methods at Oceania ports.

4. Top Import Products in Oceania Markets

| Product Category | Top Selling Items | Oceania Market Share | Profit Margin | Key Sourcing Hubs |

|---|---|---|---|---|

| Electronics & Appliances |

• Smartphones and accessories • Home appliances • Computing equipment • Audio-visual devices |

31% | 18-38% |

Shenzhen, Dongguan |

| Machinery & Industrial |

• Mining equipment parts • Agricultural machinery • Renewable energy systems • Manufacturing components |

24% | 15-42% |

Shanghai, Qingdao |

| Textiles & Footwear |

• Fashion clothing • Sports footwear • Home textiles • Outdoor apparel |

19% | 22-45% |

Guangzhou, Yiwu |

| Furniture & Home Goods |

• Indoor furniture • Home decor • Outdoor living products • Lighting fixtures |

16% | 17-40% |

Foshan, Zhejiang |

Pro Tip: Oceania buyers prioritize safety certifications (C-Tick, RCM in Australia; C-Tick in New Zealand) and energy efficiency ratings - products with these certifications command 12-20% price premiums and experience faster market penetration.

5. Oceania Cost Calculation Framework

| Cost Component | 20' Container | 40' Container | LCL (per CBM) | Notes |

|---|---|---|---|---|

| China-Oceania Freight | A$1,400-A$3,200 | A$2,400-A$4,900 | A$120-A$280 | From Shanghai/Shenzhen to major Oceania ports |

| Customs Duties (avg 4%) | 0-45% of goods value | 0-45% of goods value | 0-45% of CIF | Depends on HS code and country |

| GST (10-15%) | 10-15% of (Goods+Freight+Duty) | 10-15% of (Goods+Freight+Duty) | 10-15% of (Goods+Freight+Duty) | Australia: 10%, New Zealand: 15% |

| Terminal & Port Fees | A$280-A$750 | A$420-A$1,250 | A$60-A$200 | Includes THC, documentation, biosecurity |

| Oceania Inland Transportation | A$150-A$1,100 | A$280-A$1,650 | A$45-A$220/CBM | Depends on distance from port to final destination |

Pro Tip: Utilizing Australia's foreign trade zones such as Sydney or Melbourne can optimize cash flow through GST deferral and potential duty savings for goods undergoing processing before final distribution in Oceania markets.

6. Oceania Customs Clearance Procedures

| Step | Timeframe | Required Documents | Fee Range | Oceania Digital Systems |

|---|---|---|---|---|

| 1. Pre-Arrival Declaration | 24-48 hours before arrival |

• Commercial invoice • Packing list • Bill of Lading/AWB • Import declaration form |

A$50-A$180 (electronic submission) | Australia: ICS; New Zealand: CDS |

| 2. Customs Assessment | 1-5 working days |

• Certificate of Origin • Import licenses (if applicable) • Safety compliance certificates |

A$90-A$480 (processing fee) | Automated risk assessment systems |

| 3. Duty & GST Payment | Same day processing |

• Payment confirmation • Tax assessment notice |

Duty + GST + transaction fee (0.6-1.3%) | Australia: OCR; New Zealand: ePay |

| 4. Cargo Release | 2-24 hours after payment |

• Delivery order • Release authorization • Proof of payment |

A$60-A$260 (release fee) | Port community systems |

Pro Tip: Obtaining Authorized Economic Operator (AEO) status in Australia or New Zealand can reduce customs inspection rates by 70-85% and significantly accelerate clearance, particularly beneficial for regular China-Oceania shipments.

7. Sourcing Oceania Logistics Partners

| Partner Type | Advantages | Considerations | Verification Methods | Oceania Recommended Channels |

|---|---|---|---|---|

| Oceania Logistics Providers |

• Regional distribution networks • Local customs expertise • Knowledge of biosecurity requirements |

• Higher service costs • Limited Mandarin support outside major cities |

• Membership in Logistics Associations • AEO certification • Client references |

• Logistics Association of Australia • Customs Brokers and Forwarders Council of Australia • Freight & Logistics New Zealand |

| Oceania Import Agents |

• Local market knowledge • Regulatory compliance expertise • Distribution network access |

• Service commission (6-12%) • Variable service quality |

• Industry association verification • Client portfolio review • Trade references |

• Australian Federation of International Forwarders • Export NZ • Chamber of Commerce networks |

| Oceania Distribution Partners |

• Established retail connections • Warehousing facilities • Last-mile delivery capabilities |

• Margin requirements (18-35%) • Territory restrictions |

• Financial health check • Facility audits • Customer feedback analysis |

• National Retail Association (Australia) • Retail NZ • Industry trade shows |

Pro Tip: Partnering with Oceania logistics providers holding both AEO certification and ISO 9001 accreditation reduces compliance risks by 55-65% and ensures higher service standards across Pacific supply chains.

8. Oceania Free Zones & Logistics Hubs

| Logistics Hub | Location | Key Benefits | Setup Investment | Ideal Business Activities |

|---|---|---|---|---|

| Sydney Foreign Trade Zone | Sydney, Australia |

• GST suspension on stored goods • 24-hour customs clearance • Pacific gateway access |

A$70,000-A$350,000+ | Electronics, consumer goods, re-exports |

| Melbourne Trade Gateway | Victoria, Australia |

• Tax incentives for value-added activities • Excellent rail and road connections • Industrial cluster proximity |

A$65,000-A$320,000+ | Automotive parts, machinery, processed goods |

| Auckland Free Zone | Auckland, New Zealand |

• 15% GST deferral • Simplified customs procedures • South Pacific distribution hub |

NZ$60,000-NZ$280,000+ | Food products, pharmaceuticals, electronics |

| Brisbane Multimodal Hub | Queensland, Australia |

• Strategic Asia-Pacific location • Integrated port-air-rail connectivity • Resource industry focus |

A$55,000-A$290,000+ | Mining equipment, agricultural machinery, bulk commodities |

Oceania free trade zones offer average cost savings of 18-30% on duties and taxes for goods undergoing processing or repackaging before final distribution within the Pacific region and beyond.

9. Major Oceania Port Facilities

| Port | Specifications | Operational Capabilities | Storage Terms | Strategic Advantages |

|---|---|---|---|---|

| Port of Sydney |

• 30 kilometers of quays • 16m draft • 2.5M+ TEU capacity |

• Automated container terminals • 24/7 operations • Excellent rail/road links |

• 7 days free • A$20-A$50/day after |

Australia's premier container port, gateway to the Pacific |

| Port of Melbourne |

• 27 kilometers of quays • 14m draft • 3.0M+ TEU capacity |

• Australia's busiest port • Direct rail connections • Advanced logistics systems |

• 6 days free • A$18-A$48/day after |

Strategic location for distribution to southeastern Australia |

| Port of Auckland |

• 15 kilometers of quays • 12m draft • 1.4M+ TEU capacity |

• New Zealand's main container port • Efficient processing systems • South Pacific connections |

• 8 days free • NZ$22-NZ$55/day after |

Gateway to New Zealand and South Pacific markets |

| Port of Brisbane |

• 25 kilometers of quays • 14m draft • 1.8M+ TEU capacity |

• Fastest growing container port • Asia-Pacific focus • Integrated logistics park |

• 7 days free • A$19-A$45/day after |

Closest Australian port to Asia with fastest transit times |

Pro Tip: Using Sydney as a primary hub with rail feeder services to Melbourne can reduce overall distribution costs by 15-25% compared to direct deliveries to multiple Australian destinations.

10. Oceania Business Culture & Practices

| Aspect | Oceania Norms | Chinese Comparison | Business Implications | Recommended Approach |

|---|---|---|---|---|

| Communication Styles |

• Direct and transparent • Informal and egalitarian • Focus on clear, concise information |

Often contextual and relationship-focused Emphasis on harmony More indirect expressions |

Clear communication enhances understanding and builds trust | Prepare detailed proposals, be direct in discussions, follow up in writing |

| Business Meetings |

• Strictly punctual • Agenda-driven • Decision-making based on merit |

Relationship-focused More flexible timing Senior decision-makers required |

Professionalism and preparation are highly valued | Arrive early, prepare detailed agendas, follow up with meeting minutes |

| Contractual Relationships |

• Contracts are legally binding documents • Clear terms and conditions expected • Changes require formal amendment |

Relationships may take precedence Flexibility valued Verbal agreements carry weight |

Well-drafted contracts prevent misunderstandings and disputes | Detailed contracts with clear terms, legal review, regular performance reviews |

Pro Tip: Providing business materials in clear English with simplified language improves communication effectiveness, with 82% of Oceania business leaders reporting more positive impressions of international partners who demonstrate this clarity.

11. Oceania Regulatory Compliance Framework

| Requirement | Affected Products | Key Oceania Standards | Non-Compliance Risks | Compliance Strategies |

|---|---|---|---|---|

| Product Certification |

• Electrical and electronic equipment • Machinery • Building products • Children's items |

• Australia: C-Tick, RCM, AS/NZS • New Zealand: C-Tick, NZS • Safety certifications |

• Product seizure • Fines up to 200% of value • Market ban |

Pre-export testing by accredited laboratories, certification by recognized bodies |

| Labeling Requirements |

• All consumer products • Food and beverages • Cosmetics • Electrical goods |

• English language labeling • Ingredient/material listings • Origin marking • Safety warnings |

• Mandatory relabeling • Fines A$1,000-A$20,000 • Product refusal |

Compliance with Australia's ACL or New Zealand's Fair Trading Act |

| Biosecurity Regulations |

• Wood packaging • Food products • Plant materials • Animal products |

• Australia: DAWR requirements • New Zealand: MPI standards • Treatment certificates |

• Quarantine detention • Treatment costs • Product destruction |

Pre-export treatment, compliance with ISPM 15, proper documentation |

Oceania's strict biosecurity regulations (administered by Australia's DAWR and New Zealand's MPI) include penalties up to A$66,000 for first offenses—comprehensive pre-export documentation and treatment are essential for China-origin products entering Oceania markets.

12. Oceania Cargo Insurance & Risk Mitigation

| Coverage Type | Premium Rate | Key Protections | Exclusions | Claims Process |

|---|---|---|---|---|

| Marine Cargo Insurance |

0.4-0.8% of cargo value |

• Loss or damage at sea • Port handling issues • General average contributions • Piracy in high-risk areas |

• War and strikes • Inherent vice • Insufficient packaging |

• 24-hour notification • Survey report within 7 days • 15-30 day processing |

| Land Transport & Storage |

0.3-0.6% of cargo value |

• Road/rail transport damage • Theft during transit • Warehouse storage risks • Accidental damage |

• Willful misconduct • Mechanical breakdown • Delay-related losses |

• Police report for theft • Carrier incident documentation • 10-20 day processing |

| Regulatory & Biosecurity |

0.5-1.1% of cargo value |

• Quarantine treatment costs • Biosecurity fines • Regulatory changes impact • Documentation errors |

• Known non-compliance • Fraudulent documentation • Sanctions-related issues |

• Official documentation of issue • Compliance advisor report • 30-45 day processing |

A combined marine and land transport insurance policy with regulatory coverage (total 1.2-2.2% of cargo value) provides comprehensive protection for China-Oceania supply chains, with typical claim settlements covering 92-98% of verified losses.

Strategic Overview: Optimizing Your China-Oceania Shipping Operations

This comprehensive guide has equipped you with specialized knowledge to navigate the complexities of China-Oceania trade, including:

✓ In-depth understanding of Oceania market dynamics and regulatory requirements

✓ Strategic selection of shipping methods balancing cost, speed, and reliability across Pacific routes

✓ Accurate calculation of total landed costs including Oceania-specific duties and taxes

✓ Effective navigation of Australian and New Zealand customs procedures

✓ Identification of high-potential product categories for Oceania markets

✓ Development of risk mitigation strategies tailored to China-Oceania routes

Implementation Roadmap:

1. Conduct detailed market analysis for your specific product category across key Oceania markets

2. Evaluate multimodal transport options combining sea/air with regional distribution networks

3. Establish compliance protocols addressing certification, labeling, and biosecurity requirements

4. Develop partnerships with established Oceania logistics and distribution networks

5. Implement a comprehensive insurance strategy covering all transport segments

For personalized guidance on optimizing your China-Oceania supply chain, our team of regional specialists offers complimentary logistics assessments and customized solution design tailored to your specific industry and target markets across Oceania.