- 1. Understanding Custom Insurance Solutions

- 2. Why Choose Winsail as Your Insurance Partner?

- 3. The Step-by-Step Custom Insurance Process

- 4. Key Advantages of Custom Insurance Solutions

- 5. Insurance Network: Key Industry Specializations

- 6. Major Insurance Program Structures

- 7. How Much Does Custom Insurance Cost?

- 8. Insurance Implementation Timeline

- 9. Layered Insurance Programs

- 10. Insurance Documentation Requirements

- 11. Key Considerations for Custom Insurance Programs

- 12. Custom Insurance vs. Standard Policies: Key Comparison

Why Choose Our Custom Insurance Services?

Competitive Insurance Rates

We offer the most cost-effective insurance solutions tailored to your unique needs, balancing coverage and affordability.

Comprehensive Risk Assessment

Professional evaluation of your insurance needs including specialized coverage options and compliance with industry standards.

Real-Time Policy Management

Monitor and adjust your insurance coverage in real-time through our comprehensive digital platform.

End-to-End Insurance Solutions

Complete insurance services including policy creation, claims processing, and risk management consultation.

Optimized Coverage Plans

We design the most efficient insurance packages to meet your specific requirements and budget constraints.

24/7 Claims Support

Our insurance specialists are available around the clock to assist with any coverage or claims inquiries.

-

One-Stop Customs Clearance Solution

One-Stop Customs Clearance SolutionOne-Stop Customs Clearance Solution

As a leading freight forwarder in China, Winsail Logistics offers a comprehensive one-stop customs clearance solution, along with cargo insurance services, catering to all modes of transport for both import and export operations. As a 5-star and A-grade organization in China, we are dedicated to assisting our clients in navigating the complexities of local customs procedures. By partnering with us, you can alleviate the burden of handling China's customs documentation and clearance processes, allowing you to focus on your core business activities. We recognize the critical role that customs brokerage plays in ensuring the efficient delivery of your products to their intended destinations.

Winsail Logistics boasts a team of senior specialists stationed in major cities and seaports across China. These experts possess multilingual capabilities and a profound understanding of the intricacies of global trade regulations and agreements. They are committed to streamlining your customs processes, minimizing risks, controlling costs, and optimizing customs clearance times.

Cargo Insurance Services in China

Our insurance brokerage services are tailored to meet your specific insurance needs, whether you require coverage for a single shipment or prefer an open policy for ongoing protection. We specialize in supply chain risk assessment and develop customized, precise risk management proposals, including insurance solutions.

In the unfortunate event of loss, damage, or theft, our clients can promptly report incidents through our online incident reporting system and receive immediate guidance from our claims handling team. Generally, compensation is subject to the "limitation of liability" clauses in carriage contracts. However, our team of licensed brokerage consultants is adept at designing insurance programs tailored to your unique circumstances, aiming to secure the most favorable compensation possible.

When it comes to insuring your goods, Winsail Logistics is committed to providing the broadest possible coverage at competitive and cost-effective rates.

Winsail Commitment

Our Mission

To become a leading logistics services provider from China helping small and medium-sized enterprises succeed.

Our Vision

To grow our business together with growth of our staff, suppliers, and clients.

Our Slogan

Bear your cargo, March with safe and efficient.

Global Insurance Coverage Networks

1. North America Insurance Solutions

Insurance providers: Specialized Risk Coverage, Industry Experts, Regional Carriers, Custom Underwriters

| Service Provider | Key Locations | Coverage Specialties |

|---|---|---|

| High-Risk Specialists | Houston, Chicago, Los Angeles | Nationwide coverage for specialized industries including energy and manufacturing |

| Regional Underwriters | Kansas City, Memphis | Custom insurance products tailored to local business needs |

| Commercial Coverage Experts | Detroit, Seattle | Comprehensive business insurance for major industries and construction |

| Marine Insurance Providers | New Orleans, Baltimore | Coastal and inland waterway cargo and liability coverage |

2. Europe Insurance Solutions

Insurance providers: Pan-European Underwriters, Specialized Risk Carriers, Multinational Policies

| Service Provider | Key Locations | Coverage Specialties |

|---|---|---|

| European Risk Managers | Rotterdam, Antwerp, Hamburg | Pan-European commercial insurance for industrial projects |

| Multinational Underwriters | Duisburg, Ludwigshafen | Integrated insurance solutions across multiple jurisdictions |

| Specialty Coverage Providers | Milan, Barcelona | Custom insurance products for unique European business needs |

| Cross-Border Insurance | Strasbourg, Budapest | River transport and inland coverage solutions |

3. Australia & New Zealand Insurance Solutions

Insurance providers: Mining Risk Specialists, Regional Underwriters, Remote Area Coverage

| Service Provider | Key Locations | Coverage Specialties |

|---|---|---|

| Resources Sector Insurance | Perth, Brisbane | Specialized coverage for mining and energy projects |

| Commercial Risk Australia | Melbourne, Sydney | Comprehensive business insurance for major industries |

| Remote Area Coverage | Darwin, Adelaide | Insurance solutions for outback and remote operations |

4. Asia & Middle East Insurance Solutions

Insurance providers: Emerging Market Specialists, Energy Sector Underwriters, Infrastructure Coverage

| Service Provider | Key Locations | Coverage Specialties |

|---|---|---|

| Industrial Risk Managers | Singapore, Shanghai | Custom coverage for Asian infrastructure and manufacturing |

| Energy Sector Underwriters | Dubai, Doha | Specialized insurance for oil & gas projects |

| Mega Project Coverage | Mumbai, Jakarta | Integrated insurance solutions for large-scale developments |

Custom Insurance Conclusion:

No matter what coverage your business requires, our insurance services guarantee professional protection at every level. Staffed by certified insurance specialists available 24/7, we ensure your assets and operations are secured cost-effectively with policies tailored to your schedule - whether you need local or international coverage. Our network covers all major industries with continuous support, where experienced teams manage your policies and claims.

Our experts will guide you through all essential insurance requirements, including compliance policies and risk mitigation options, while providing complete support with coverage planning and specialized documentation. Whatever your specific industry or unique risk profile may be, we deliver customized insurance solutions that prioritize protection, value, and reliability for complex business needs.

Your Complete 2023 Guide | Custom Insurance Solutions for Global Businesses

As a world-leading provider of specialized risk solutions, our Custom Insurance services offer comprehensive protection networks that safeguard businesses operating in global markets.

The strategic advantage of custom insurance lies in its tailored approach to complex risks, with companies like Winsail Insurance offering engineered coverage solutions designed for specific industries.

New to custom insurance solutions? This comprehensive FAQ guide provides all the essential information you need for optimal risk protection and coverage.

1. Understanding Custom Insurance Solutions

| Aspect | Details |

|---|---|

| Overview | Custom insurance has emerged as the most effective solution for business clients, offering specialized coverage for unique risks and industry-specific challenges. |

| Network | This protection network connects businesses with tailored coverage options worldwide, creating customized risk management solutions for various industries. |

| Why Choose Custom Insurance |

• Specialized Coverage: Designed for unique business risks • Risk Engineering: Handles complex liability scenarios • Reliability: Professional management of sensitive exposures |

| Winsail Insurance Advantages |

✓ Tailored coverage solutions ✓ Risk assessment and mitigation ✓ Comprehensive protection across all business operations |

2. Why Choose Winsail as Your Insurance Partner?

| Feature | Benefits |

|---|---|

| Specialized Products |

• Industry-specific policy forms • Excess liability solutions • Captive insurance programs |

| Value-Added Services |

• On-site risk assessments • Claims management consulting • Loss control engineering |

| Unmatched Expertise |

• Experienced in complex risks • Seamless coordination across coverages • Specialized handling for unique exposures |

| Complete Policy Visibility |

• Real-time coverage tracking • Proactive risk updates • 24/7 claims support |

3. The Step-by-Step Custom Insurance Process

| Step | Process Details |

|---|---|

| Step 1: Request Quote |

• Complete our online form or contact our team • Provide business operations details, current coverage information, and special protection requirements |

| Step 2: Risk Assessment |

• We conduct exposure analysis • Develop risk mitigation plans |

| Step 3: Coverage Design |

• Custom policy drafting • Special endorsements • Limits and deductible structuring |

| Step 4: Market Placement |

• Complete program design • Handle specialty markets • Reinsurance arrangements |

| Step 5: Implementation |

• Policy issuance • Certificate management • Continuous monitoring |

| Step 6: Ongoing Service |

• Claims advocacy • Flexible renewal options: ✓ Program reviews ✓ Coverage enhancements ✓ Risk management updates |

4. Key Advantages of Custom Insurance Solutions

| Advantage | Details |

|---|---|

| 1. Tailored Protection |

• Designed for specific exposures • Professional risk analysis • Minimizes coverage gaps |

| 2. Risk Engineering |

• Exposure planning • Loss scenario analysis • Custom mitigation solutions |

| 3. Global Network |

• Access to specialty markets • Local compliance knowledge • International program coordination |

| 4. Regulatory Compliance |

• Policy compliance expertise • Cross-border coverage solutions • Complex risk handling |

| 5. Risk Management |

• Specialized coverage • Contingency planning • Loss prevention |

5. Insurance Network: Key Industry Specializations

| Industry Sector | Coverage Focus | Policy Availability | Key Features |

|---|---|---|---|

| Manufacturing | Product liability, equipment breakdown | Year-round | Custom production coverages |

| Energy | Oil & gas operations, renewables | Year-round | Specialized energy packages |

| Construction | Project policies, contractor risks | Year-round | Wrap-up programs |

| Technology | Cyber liability, E&O | Year-round | Innovative tech solutions |

| Healthcare | Malpractice, facility risks | Year-round | Specialty medical programs |

6. Major Insurance Program Structures

| Program Type | Key Features | Best For | Availability | Implementation Time |

|---|---|---|---|---|

| Single Parent Captive | Wholly-owned subsidiary | Fortune 500 companies | Year-round | 3-6 months |

| Group Captive | Shared ownership | Industry associations | Annual enrollment | 2-4 months |

| Rent-a-Captive | Third-party administration | Emerging companies | Quarterly | 4-8 weeks |

| Protected Cell | Segregated accounts | Specialty risks | Monthly | 2-6 weeks |

7. How Much Does Custom Insurance Cost?

| Cost Factor | Pricing Details |

|---|---|

| 1. Coverage Type |

Standard Liability: ✓ $1,000-5,000 per million ✓ Annual premium Specialty Coverage: ✓ $5,000-20,000 per million ✓ Annual premium |

| 2. Risk Profile |

Low Risk: ✓ Basic pricing ✓ $500-2,000 per million High Risk: ✓ Requiring special underwriting ✓ Premium of 50-200% more |

| 3. Market Conditions |

Hard Market: ✓ 20-40% price increase |

| Cost-Saving Tip |

Plan coverage with Winsail Insurance to: • Access program discounts (up to 15% savings) • Optimize risk transfer • Avoid peak market surcharges |

8. Insurance Implementation Timeline

| Service Type | Timeframe |

|---|---|

| Standard Program |

• 4-8 weeks implementation • Includes underwriting clearance |

| Express Placement |

• 1-2 weeks for urgent needs • Priority underwriting |

| Program-Specific Timelines |

• Captive formation: 3-6 months • Specialty programs: 4-8 weeks • Renewal processing: 2-4 weeks • Endorsements: 1-3 days |

| Pro Tip | Custom insurance's specialized underwriting ensures proper coverage for unique risks that standard policies can't address. |

9. Layered Insurance Programs

| Aspect | Details |

|---|---|

| Availability | Yes, layered insurance programs are available for clients requiring excess coverage beyond primary limits. |

| Cost and Efficiency | Layered programs provide affordable options for large risks or catastrophic exposures. |

| Placement Process | Your coverage is structured across multiple insurers to optimize capacity and cost. |

| Service Provider | For complex layered programs, Winsail Insurance specializes in efficient structuring of excess coverage towers. |

10. Insurance Documentation Requirements

| Document Type | Requirements |

|---|---|

| Mandatory Documents |

• Detailed operations description • Financial statements • Loss history • Current coverage details • Risk management procedures |

| Special Underwriting |

• Engineering reports for complex risks • Custom policy wording • Reinsurance agreements |

| Custom Insurance Rules |

For specialized coverage: • Risk surveys required • Special underwriting considerations • Tailored policy conditions |

| Restricted Risks |

Additional limitations may apply to: • Catastrophic exposures • Uninsurable operations • Prohibited activities |

11. Key Considerations for Custom Insurance Programs

| Consideration | Details |

|---|---|

| Overview | Before choosing custom insurance, evaluate these critical factors to ensure comprehensive protection for your business. |

| Coverage vs. Cost | Custom insurance offers specialized solutions but requires careful planning and budgeting. |

| Risk Profile | Ensure proper assessment of all exposures and vulnerabilities. |

| Special Coverage Needs | Unique business operations require advance consultation with your provider. |

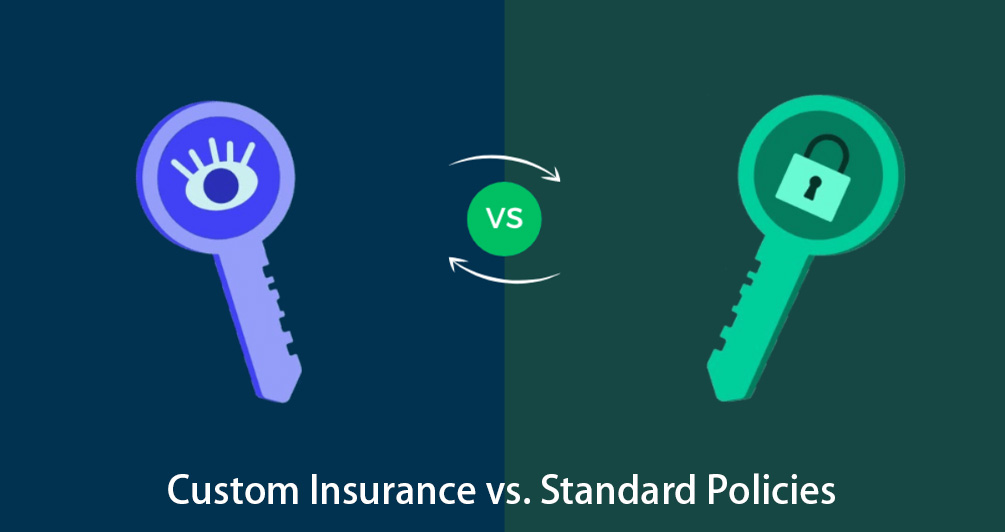

12. Custom Insurance vs. Standard Policies: Key Comparison

| Feature | Custom Insurance | Standard Policies |

|---|---|---|

| Key Advantages |

Covers unique risks Professional risk engineering Global program coordination Specialized policy forms |

Lower costs Faster issuance Simpler documentation |

| Limitations |

Higher costs Longer placement times Complex administration |

Coverage restrictions No specialized underwriting Limited to standard forms |

| Best For |

Unique business risks Complex operations Global coverage needs |

Routine coverage needs Standard risks Basic protection |

Pro Tip: Choose custom insurance for unique business risks; select standard policies only for routine coverage needs.

Conclusion Summary

Custom insurance provides the most effective solution for unique business risks—ideal for companies where specialized protection outweighs cost considerations.

Global Coverage Solutions

Extensive underwriting capabilities ensure protection for challenging risks worldwide.

Service Provider Assurance

For reliable custom insurance, partner with Winsail Insurance—your dedicated risk management expert offering comprehensive coverage solutions.

Ready to discuss your insurance needs? → Contact Winsail Insurance now for tailored risk protection solutions!